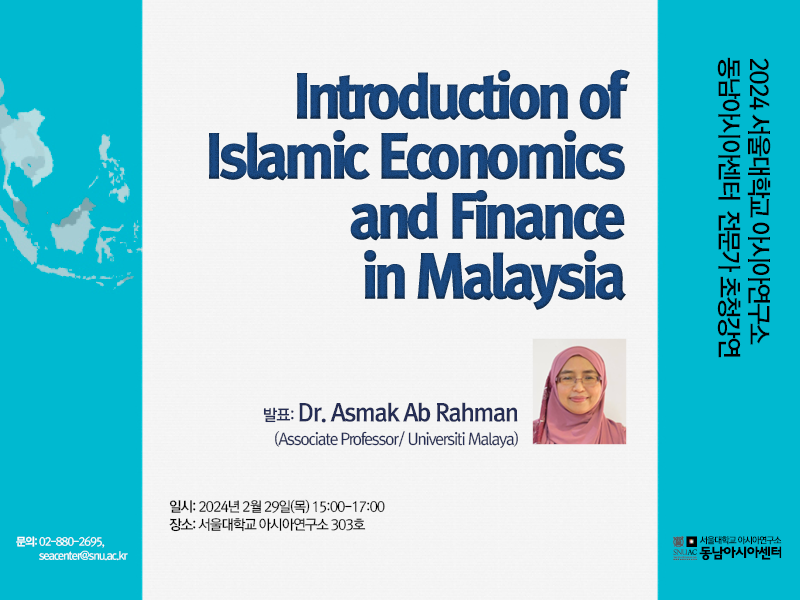

Introduction of Islamic Economics and Finance in Malaysia

- Date: February 29th, Thursday, 2024, 15:00 – 17:00

- Location: Room 303, SNUAC (Bldg. 101)

Malaysia, with a diverse population of 32.4 million, exemplifies a multi-ethnic and multi-religious society where various groups and religions coexist harmoniously. The majority of Malaysians can be categorized into four primary racial groups: Malays and indigenous peoples, collectively known as Bumiputera (69.4%); Chinese (23.2%); Indians (6.7%); and a minority from other backgrounds (0.7%). The nation embraces Islam as its official religion while guaranteeing the peaceful practice of other faiths. The religious composition of Malaysia reflects its rich diversity, with 63.5% adhering to Islam, 18.7% to Buddhism, 9.1% to Christianity, 6.1% to Hinduism, and 2.6% following other religions. Malaysia has established a dual financial system, which has become an integral part of its financial landscape. This dual financial system allows for the coexistence of the Islamic financial system alongside the conventional one and has continued to develop and evolve over time, maturing into the system it is today. Islamic economic and financial principles, deeply rooted in Islamic teachings, have resonated with the Muslim population, leading to the development of various Islamic financial instruments and services. This journey began with the establishment of Lembaga Tabung Haji (Muslim Pilgrimage Fund Board) in 1967—an institution that collects deposits from pilgrims and provides Shariah-compliant savings management and efficient hajj services. The integration and growth of Islamic economics and finance within Malaysia’s financial landscape encompass Islamic banking, Takaful (Islamic insurance), Islamic capital markets, the halal industry, and the establishment of Islamic social finance. These elements have become integral components of Malaysia’s economic system, catering not only to the Muslim population but also attracting interest from diverse segments of society. Shareholders, management, employers, employees, consumers, and users of Islamic financial institutions and halal products may include both Muslims and non-Muslims.

Dr. Asmak Ab Rahman is an Associate Professor at the Department of Shariah and Economics, Academy of Islamic Studies, Universiti Malaya (UM). She holds a PhD in Islamic Economics, along with a Master’s degree and a Bachelor’s degree in Shariah from UM. A leading expert in Islamic economics and finance, Dr. Asmak’s research spans various areas, with a particular focus on Islamic Insurance, Islamic Finance, Islamic Banking, Islamic Social Finance, and Shariah.

Throughout her career, Dr. Asmak has held prestigious positions. She served as the Head of the Department of Shariah and Economics at the Academy of Islamic Studies, Universiti Malaya. Currently she is a Committee member of the Universiti Malaya Zakah Fund. She also contribute her expertise as a Managing Editor for the faculty journal, Shariah Journal.

Her expertise has been widely recognized by the Islamic Finance industry, and she currently serves as a Shariah Committee member for Affin Islamic Bank Berhad, FWD Takaful, Tabung Haji, and Permodalan Usahawan Nasional Berhad. Previously, she was appointed as a Shariah Committee member for Ambank Islamic, SME Bank, Hong Leong MSIG Takaful, and BIMB Investment.